COVID-19: Focus on Italy. The sixth legislative recap

An overview of the situation in Italy, with regards to the Covid-19 contagion spread and the Government’s response. You will find:

- A timeline of the major events that marked the contagion spread and the measures taken by the Government

- An overview of how the resumption of economic activity played out during phase 3 of the response to the epidemic

- A major shift in the distribution of powers: the Regions are now in charge of presiding over “phase 3”

- The impact of the reopening on the contagion spread: the Ministry of Health detected “warning signals” from three Regions in its latest weekly health risk assessment

- An overview of the Government’s €55 billion economic recovery package

- The expected impact of the €55 billion package on public finances as the economy shrinks due to the lockdown: macroeconomic estimates produced by the Treasury in its Multiannual Financial Framework

- Next steps in the Government’s economic policy agenda, with a focus on the political debate on whether Italy should apply for an ESM credit line or not

- Debate on how to shield strategic companies from foreign takeover: implementation of the Government’s s.c. Golden Power

- The latest available data on the contagion spread (as of 23 June)

TIMELINE

22 January 2020

Ministry of Health Guidelines to healthcare units: patients to be tested for coronavirus include those showing symptoms of severe acute respiratory infection who have also visited China in the 14 days before the symptoms or have been in contact with someone who has.

31 January

All direct incoming flights from China, Hong Kong, Macau and Taiwan suspended. Still no measure in place to test and place in quarantine those arriving from other countries after visiting China.

8 February (until 22 February)

The Ministry of Health runs an ad on national TV channels where a well-known actor says that “the contagion spread is not at all easy”.

18-20 February

“Patient 1” visited in a hospital in Codogno, south of Milan (Lombardy Region). According to the Guidelines of the Ministry of Health, he is not tested because he had not visited China, and he is sent home on 18 February. Symptoms get worse and he shows up again the next day: this time he is tested and diagnosed with coronavirus, after infecting his relatives, several patients in that hospital as well as health professionals. This marks the beginning of the (recorded) circulation of the virus in Italy.

22 February

The Ministry of Health revises its guidelines to healthcare units: those who show symptoms of a severe acute respiratory infection should also be tested.

24 February

Government establishes two “Red Zones” which are completely locked down:

- 10 towns in Lombardy (including Codogno)

- 1 town in Veneto

Business activities are suspended in that area.

1 March

The rules applying to the “Red Zones” are extended until 8 March.

A “Yellow Zone” is established, including 3 Northern Regions (Lombardy, Veneto, Emilia-Romagna) plus 2 other Provinces in other neighbouring Regions.

Restrictions to social interaction were in place throughout the “Yellow Zone” (including the suspension of sports events, organized public gatherings, school and university attendance, limitations on the opening hours of museums, restaurants, bars, shops, malls etc.) but there was no generalised suspension of business activities.

2 March

The Government adopts legislation providing for an extension of deadlines for tax/bill payments for households and businesses in the “Red Zone”.

4 March

A number of restrictions are imposed on the whole country. School and University attendance is suspended until 15 March.

8 March

The lockdown regime is lifted on the 11 towns of the former “Red Zone”. Lombardy + other 14 Northern Provinces now form an “Orange Zone”, where severe limitations to social interaction, freedom of movement and some business activities apply, but no lockdown is in place: manufacturing sites continue to be operational and transport of goods is not affected.

9 March

The “Orange Zone” regime is extended to the whole country, until 3 April.

11 March

The “Orange Zone” regime is tightened: with a few exemptions, retail merchants are shut down until 25 March. Manufacturing sites are still not impacted.

11 March

Upon the Government’s request, Parliament authorised an increase in the 2020 deficit ceiling by €25bn.

14 March

Amid blue collars’ protests, the Government signs a protocol with Unions and business associations to safeguard workers’ health in manufacturing sites, in an attempt at avoiding a shutdown of factories.

17 March

The Government passes, with the Decree-Law 17 March 2020, n. 18, a €25bn package of measures to provide economic relieve to households and businesses.

22 March

The “Orange Zone” is further tightened through a Prime Minister Decree: the lockdown now applies to manufacturing sites as well, although with several exemptions. All previous measures are extended until 3 April.

24 March

Restrictions on the movement of people are also extended until 3 April, including an obligation for anyone entering Italy to undergo a 15-day quarantine (unless they are entering the country for proven work reasons, in which case they can stay in Italy for no longer than 5 days).

25 March

- The list of manufacturing sectors that are exempted from the lockdown is slightly amended through Decree 25 March 2020 signed by the Minister of Economic Development, Patuanelli.

- The Government sets out a new legal framework (Decree-Law of 25 March 2020 n.19) for any future restriction until 31 July. Regions may adopt additional restrictions but are not allowed to take measures that impact on production facilities.

28 March

Amid concerns about the spread of poverty throughout the country, the Government distributes €400 million to local Administrations (Municipalities) so that they can provide low-income citizens with food stamps.

1 April

The “Orange Zone” regime is extended until 13 April.

3 April

Peak of patients in intensive care units (4,068). This figure started declining on 4 April

4 April

Peak of (non-ICU) hospitalised patients showing Covid-19 related symptoms (29,010). This figure started declining on 5 April

6 April

The Government passes a new package of measures to provide liquidity support to businesses (Decree-Law of 8 April 2020 n.23): bank loans to businesses are assisted with the State’s guarantee, with a view to mobilising up to €200 billion.

Moreover, this package includes measures (specifically, art. 15, 16 and 17) extending the scope of the s.c. Golden Power (e.g. special intervention power aimed at protecting strategically-relevant assets from foreign acquisition, by imposing conditions or even vetoing notified transactions).

10 April

The “Orange Zone” regime is extended until 3 May, with minor exemptions.

14 April

First meeting of the working group (chaired by former CEO of Vodafone Vittorio Colao) which will deliver recommendations to the Government on when to lift the restrictions on individual economic sectors.

19 April

Peak of confirmed active cases (108,257). This figure started declining on 20 April, which means that the total number of patients who recover or die over the last 24 hours is higher than the number of new cases.

20 April

The Regional and Mayoral elections scheduled in May-June 2020 were postponed to September-December.

26 April

A PM Decree sets out the rules applying from 4 May to 17 May (“phase 2”): factories and businesses in the construction sector are allowed to reopen, conditional upon compliance with workers’ safety protocols.

30 April

A Decree of the Minister of Health lays down the indicators according to which this risk assessment will be conducted during “phase 2” with a view to detecting any threats and adopt restrictions on a regional or sub-regional basis accordingly.

4 May

“Phase 2” begins, according to the rules set out by the PM Decree of 26 April

13 May

The Cabinet adopts a €55 billion economic recovery package

16 May

The Cabinet adopts the Decree-Law of 16 May 2020 n.33, providing for the legal framework for the gradual resumption of the movement of people and economic activity until the end of the covid-19 emergency (31 July).

17 May

A PM Decree lifts most restrictions on economic activity and restores free movement of people within their own Region starting from 18 May.

3 June

Pursuant the PM Decree of 17 May, free movement of people is restored across regional borders and to/from Schengen area countries

9 June

The working group of experts appointed by the Prime Minister and chaired by former Vodafone CEO Vittorio Colao submits its final report “Italy 2020-2022: Initiatives for recovery” to the Government.

11 June

A PM Decree sets the regulatory framework applying in the following month. Movement of people to/from non-European countries remains restricted at least until 30 June.

13-20 June

The Prime Minister consults with a wide array of economic and social categories, with a view to gathering suggestions for the forthcoming economic recovery plan, basing on which Italy will ask for its share of the “Next Generation EU” funds.

PHASE 3 OF THE RESPONSE TO THE EPIDEMIC: STATE OF PLAY OF THE REOPENING PROCESS

Officially, the Covid-19 emergency will end on 31 July: this is when all the existing restrictions will cease applying, unless the Government decides otherwise.

In here are the main rules applying from 15 June to 14 July, pursuant the PM Decree of 11 June.

PHASE 2-3: THE REGIONS ARE NOW IN CHARGE

Regions have obtained that the decision-making power is handed over to them with regards to:

- [Collectively] presiding over the resumption of economic activities

Sector-specific protocols with safety guidelines that business should comply with when they re-open were adopted by the Conference of the Regions, and replaced the much stricter rules that had been proposed by the national Government.

- [Individually] allowing certain economic activities to reopen, basing on the contagion spread risk in their own jurisdiction

- [Individually] Restoring restrictions whenever needed

In case the health risk assessment conducted by the Ministry of Health on a number of indicators (e.g. contagion rate, intensive care units capacity, etc.) shows any serious contagion threat in a Region or in a sub-regional area, it will be up to the relevant Regional President to take the ultimate decision of imposing or lifting restrictions, by simply informing the Minister of Health.

LATEST HEALTH RISK ASSESSMENT (8-14 JUNE): SOME “WARNING SIGNALS” FROM THREE REGIONS

Basing on the data submitted by the Regions and Autonomous Provinces in the week between 8 June and 14 June, the Ministry of Health concluded that overall, the risk associated with a covid-19 contagion spread is still low across the country, but warning signals are emerging in a number of Regions.

For the first time, the health risk assessment exercise detected an increase in the incidence of the epidemic in three large Regions (Lombardy, Emilia-Romagna and Lazio) following the reopening of retail stores and other economic activities (i.e. the second step in the resumption of economic and social life, which started on 18 May).

The data basing on which the assessment was carried out are not recent enough for the Ministry to draw any conclusion on the impact of the third step, i.e. the resumption of free movement of people across Italian Regions and across the Schengen area, which was only restored on 3 June – this will only be assessed in the weeks to come.

Still, the recorded increase in the incidence of the epidemic did not bring any threat to the capacity of hospitals and ICUs.

Despite the “warning signals”, the Ministry is not recommending any “red zone” or any other change in the schedule of the reopening.

€55 BILLION ECONOMIC RECOVERY PACKAGE to tackle the economic downturn

The package was adopted by the Cabinet on 13 May but has not been published yet. These are the main provisions:

Income support schemes (€25.6 billion overall)

- Lay-off schemes for employees whose businesses have either temporarily closed down or reduced their activity due to the lockdown will be extended up to 14 weeks until August 2020, plus 4 more weeks in September-October 2020

- Self-employed workers or those employed under non-permanent contracts who have experienced a significant drop in their income during the lockdown will be entitled to a direct cash payment of €600 for April and €1,000 for May.

Aid to businesses (€16 billion)

- Small businesses with a turnaround up to €5 million will receive direct aid from the Government, on the condition that their turnaround dropped in April 2020 by at least one third vs. April 2019; the aid will be calculated as a percentage of the recorded turnaround drop

- Businesses with a turnaround between €5 and €50 million, whose turnaround dropped by at least one third in April 2020 vs. April 2019, will benefit from a tax credit if they undergo a capital increase in the form of an issue of shares for cash within the end of 2020

- The Treasury through Cassa Depositi e Prestiti (CDP) will lend temporary support to businesses established in Italy, with a turnaround exceeding €50 million, in various forms (e.g. by underwriting bonds convertible into equity, taking part in capital increases, purchase shares on the secondary market etc.); CDP will preferably support high-tech businesses, or those managing critical infrastructures, or those that are part of strategic supply chains, or those that are relevant in terms of employment levels.

Temporary tax cuts (€4 billion) + other tax-related measures

- Businesses with an annual turnaround up to €250 million will be exempted from 2 instalments of the regional Tax on Productive Activities (IRAP)

- Tax payments and social security contributions will be suspended until 16 September 2020

- Moreover, the increase in VAT rates and excise duties already legislated for 2021 onwards will be suppressed.

Additional funding for the NHS and the civil protection department (€3.25 billion)

- The capacity of intensive care units will be permanently improved, from approximately 5,000 to 8,400 beds. The capacity of semi-intensive units will also be improved, thanks to 4,225 more beds

- Community health services will be strengthened by hiring up to 9,000 more nurses

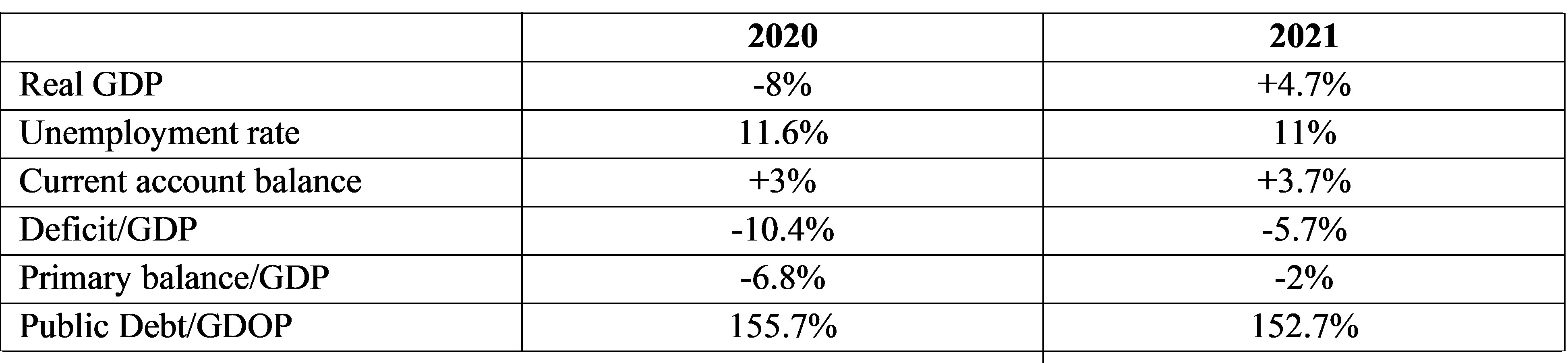

IMPACT OF THE ECONOMIC RECOVERY PACKAGE ON PUBLIC FINANCES

Additional expenses will result in a record-high public debt as the economy shrinks due to the lockdown.

According to the estimates produced by the Treasury in its Multiannual Financial Framework, Italy will record a primary deficit for the first time since 1991 (with the only exception of 2009):

GOVERNMENT’S ECONOMIC RECOVERY AGENDA: NEXT STEPS AND POLITICAL DEBATE ON THE EUROPEAN STABILITY FUND

Following the adoption of the €55 billion package, the next steps in the Government’s action to tackle the economic downturn will be crucially influenced by the decisions to be taken at the EU level on the financial support to Member States, particularly through the “Next Generation EU” funds.

At the moment, the Government’s plan is the following:

- In early July, the Cabinet will adopt a national reform plan, taking into account the suggestions received from business associations

- In September, the Italian Government will submit a national recovery plan to the European Commission, for the purpose of applying for the “Next Generation EU” funds

- Within 27 September, the Cabinet will then adopt its updated multiannual financial framework, with its macroeconomic estimates for 2020, 2021 and 2022

- Within 20 October, the Cabinet will adopt its draft 2021 Budget, which is scheduled to be passed by Parliament within 31 December.

Since the “Next Generation EU” funds will only be available at a later stage (most likely next year), the Government might want to apply for a European Stability Mechanism (ESM) credit line under the new pandemic crisis support scheme, i.e. with lightened conditionalities: funds available under this scheme would be up to 36 billion (2% of the national GDP), borrowed at an interest close to zero, which Italy would be allowed to spend only for the purpose of financing direct and indirect healthcare, cure and prevention related costs due to the covid-19 crisis.

However, the Five Star Movement (largest party in the majority supporting the Government) is officially opposed to resorting to an ESM loan, as are the Eurosceptic opposition parties on the right (Lega and Fratelli d’Italia), while the moderate majority parties (Democratic Party and Italia Viva) and the main business associations are putting pressure on the Prime Minister to use the ESM funds.

The Prime Minister has refrained so far from bringing the issue to Parliament, but he will be forced to do so in July, or in September at the latest, because cannot apply for an ESM credit line without Parliament’s authorisation.

This issue has a potential for threatening the Government’s stability: the debate on the ESM could bring about a split in the Five Star Movement and, potentially, pave the way to the formation of a different majority, including centre-right Forza Italia (currently an opposition party). Most likely, in this scenario PM Conte would be replaced: hence, his cautious attitude on the ESM issue, which he regards as too hot to handle.

DEBATE ON HOW TO SHIELD STRATEGIC COMPANIES FROM FOREIGN TAKEOVER: IMPLEMENTATION OF THE GOVERNMENT’S s.c. GOLDEN POWER

The Decree-Law n.23/2020 expanded the scope of the s.c. Golden Power, an investment screening mechanism established in 2012 whereby any transaction affecting the corporate governance and shareholding structure of a strategic company, whether it be public or private, listed or non-listed, shall be notified to the Government, which in turn may set additional requirements or block the transaction altogether.

On 28 May, the Cabinet agreed upon the draft text of a Prime Minister’s Decree implementing Decree-Law 23/2020. In particular, the draft PM Decree identified a detailed list of goods and transactions on which the Government may resort to its special intervention power aimed at protecting strategically-relevant assets from foreign acquisition.

In the meantime, the centre-right opposition has advanced proposals to further enhance the investment screening mechanism, amid growing fear of a massive wave of hostile takeovers (particularly in the financial sector: Generali, Mediobanca and Borsa Italiana if LSE is required to divest from it to get the European Commission’s greenlight on its merger with Refinitiv). In a recent statement, the President of COPASIR (the Parliamentary Committee on intelligence agencies), Raffaele Volpi (Lega) suggested that the Government should assess the possibility to introduce an ex-ante authorization regime, replacing the current one based on notification and assessment, even though only for a transitional period. The Deputy President of COPASIR, Adolfo Urso (Fratelli d’Italia), said that on top of the authorization regime he would like to see more severe rules in place to discourage the acquisition of shares of domestic companies by EU competitors (again, even though for a transitional period).

Also, the President of Consob (Italy’s supervisory authority on listed companies and the stock market) urged the Government to adopt the implementing acts swiftly, so that certainty is restored among market operators of the scope of the new rules on Golden Power.

CONTAGION SPREAD LATEST AVAILABLE DATA (23 June)

These are the official data which are updated on a daily basis by the Italian Government:

Tests: ~ 5.05 million

Overall number of people who were infected with Covid-19: 238,833

Deaths: 34,675

People fully recovered: 184,585

Confirmed cases as of 23 June: 19,573 [peak: 108,257 on 19 April]

Of the confirmed cases:

- Hospitalised patients (showing symptoms): 1,853 [peak: 29,010 on 4 April]

- Under intensive care: 115 [peak: 4,068 on 3 April]

- In quarantine at home: 17,605

SocialTelos